Easily discovers anomalies in everyday data without needing prior training

Fujitsu Limited today announced that it is providing Nomura Securities Co., Ltd. with an analytical AI (machine learning technology), which will be deployed in June 2017. This will enable further improvements to data quality in areas where conventional methods of ensuring data quality had reached their limits by taking an autonomous analytical approach, using actual data and AI, to find situations that deviate from the norm.

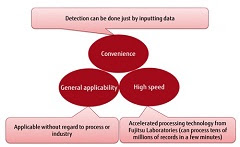

Using the opportunity of this deployment, Nomura Securities plans to expand the range of its systems that apply this technology, with the goal of further improving data quality. In addition, noting the general applicability of the technology that is now being adopted by Nomura Securities, Fujitsu plans to offer it in other industries as well.

Background

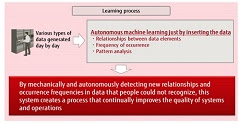

In Nomura Securities’ IT department, there has been a demand for a high quality system that can swiftly deal with the fast-paced changes in the environment of the securities business. In addition, alongside the processing performed by securities systems, there has also been needs for continuous improvement in the quality of data recorded and stored day by day through such processes as a variety of manual entry tasks and internal business processes. In previous methods of ensuring data quality, however, there were limitations in the ability to grasp human input errors and the patterns of occurrences when data deviated from the norm.

About the Analytical AI Technology

Fujitsu and Nomura Securities carried out a joint trial focusing on the occurrence tendencies and frequencies of past data. Using machine learning core technology and acceleration technology developed by Fujitsu Laboratories Ltd., the two companies verified whether this system can autonomously analyze data simply run through the system, without any prior training, after separating it into ordinary patterns and patterns that deviate from the norm (anomalies).