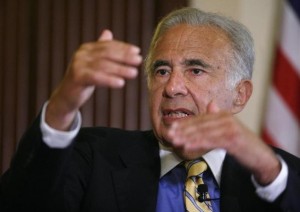

Billionaire investor Carl Icahn is preparing a higher bid for computer maker Dell Inc ahead of a key shareholder meeting after proxy firms endorsed founder Michael Dell’s $24.4 billion buyout offer.

Billionaire investor Carl Icahn is preparing a higher bid for computer maker Dell Inc ahead of a key shareholder meeting after proxy firms endorsed founder Michael Dell’s $24.4 billion buyout offer.

Ichan told Bloomberg TV that he will make a higher bid that will include a warrant by Friday morning.

Icahn, along with Southeastern Asset Management, had proposed an offer that would see shareholders tender 1.1 billion shares at $14 apiece, rivaling Michael Dell’s and Silver Lake’s buyout offer of $13.65 a share.

“We think the warrant will be around $20, to buy the stock at $20, and we’re going to give the shareholders a piece of that warrant,” he told Bloomberg.

The billionaire investor has said Michael Dell’s offer substantially undervalues the company. Dell’s special board committee had recommended Michael Dell’s offer to shareholders.

Icahn said a founder should not be running the company “years later when it matures.”

Unless Dell’s special board changes its recommendation, any proposal from Icahn will be put to shareholders only if the offer by Michael Dell and Silver Lake is not accepted by shareholders when they meet on July 18.