4 mins read

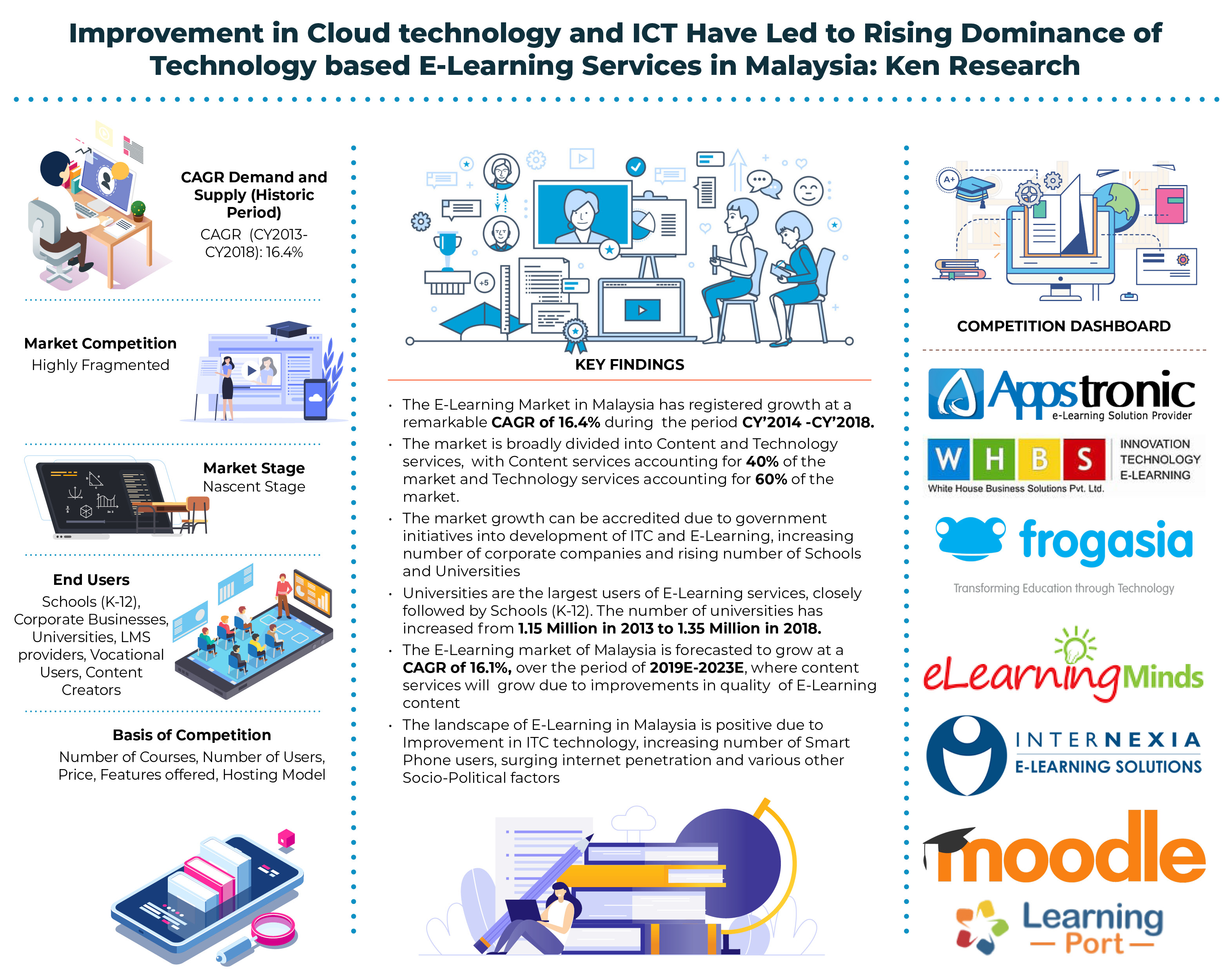

Malaysia E-Learning Market Outlook 2023: Ken Research

March 29, 2025

Copyright 2023, IT Voice Media Pvt. Ltd.

All Rights Reserved

opics for government and competitive exams. These courses follow a strict syllabus and clear guidelines.

opics for government and competitive exams. These courses follow a strict syllabus and clear guidelines.