BankChain, a platform for banks in India to explore, build, and implement blockchain solutions, has selected Microsoft Azure as their exclusive cloud partner.

BankChain, a platform for banks in India to explore, build, and implement blockchain solutions, has selected Microsoft Azure as their exclusive cloud partner.

As a part of this partnership, the 20 BankChain members that include State Bank of India (SBI), ICICI Bank, DCB Bank, Kotak Bank, Bank of Baroda, Deutsche Bank, and others, will use Microsoft Azure Blockchain as the underlying blockchain platform.

Microsoft will work closely with Primechain Technologies, the driving force behind the BankChain consortium, to develop various blockchain use cases. The first active project is Primechain-KYC, a permission based blockchain for integrated and shared Know Your Customer (KYC), Anti Money Laundering, and Countering the Financing of Terrorism.

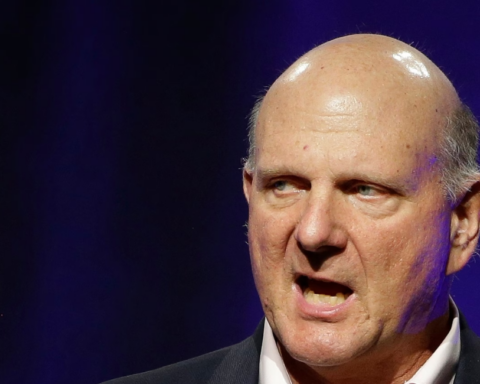

“The partnership with BankChain underscores our commitment to enable the digital transformation of the BFSI sector in India. Blockchain is one of the most exciting innovations in this sector and we at Microsoft are leading this trend by offering the best-in-class Azure Blockchain offering. We look forward to working with stakeholders like Primechain to make this partnership a success” said, Peter Gartenberg, General Manager, Enterprise and Partner Group, Microsoft.

SBI’s Collaborative Innovation Centre (CIC) along with other banks in BankChain will start testing and validating various Primechain Blockchain Pilots on Microsoft Azure Cloud nodes. Sudin Baraokar, Head Innovation, SBI states, “Azure will help enable agile Cloud nodes build and configuration. This will propel the BankChain consortium members to work together as a unified team”. Prasanna Lohar, Head Innovation, DCB Bank believes, “With Microsoft we will see immense blockchain transformation to address enhancements like provision of interface, interoperability, security, ease of integration with other systems, etc. We anticipate seeing a great technology architecture build on Microsoft Azure which will help us build the Blockchain Banking Platform.”

“Blockchain technology can help banks improve customer satisfaction, minimize fraud, and maximize efficiency, security, and transparency,” said Shinam Arora, CEO, Primechain Technologies. “We are excited to collaborate with Microsoft and bring in their expertise and globally-trusted solutions to help the banks address these challenges take the next quantum leap,” she added.

Blockchain has immense potential to fundamentally change the way markets and governments work. According to KPMG[1], over the next quarter, there will likely be a continued focus on developing more robust business cases for blockchain solutions, while interest in blockchain will likely expand further into the insurance and asset management sectors. The government is expected to release regulations for fintech, particularly related to peer-to-peer lending, which could lead to additional activity. From an overall fintech activity perspective, in Q1’17 interest grew in India, and it accounted for around four of the top ten deals this quarter. Payments and lending drove investment although interest in AI also increased. Heading into Q2’17, AI and blockchain are expected to remain big bets for fintech investors in Asia, in addition to payments, open data and data analytics.

Recognizing this trend early on, Microsoft launched Azure Blockchain that provides an open, hyper-scale cloud platform, and an expanding ecosystem of blockchain technologies for enterprises, consortiums, and governments. It enables them to learn and innovate quickly through pilots and prototypes in a cost-effective manner. In India, the availability of Microsoft Azure Blockchain from local, hyper-scale datacenters, with their hybrid cloud capabilities, extensive compliance certification portfolio, and enterprise-grade security will help enable rapid blockchain adoption in regulated sectors like banking and financial services, insurance and healthcare, as well as governments.

Today, more than 80 percent of the world’s largest banks and more than 75 percent of the global systemically important financial institutions are using Microsoft Azure, representing the highest bar for legal, compliance, security, and acquisitions teams.