The Nippon Telegraph and Telephone company is said to spend 4.25 trillion Japanese yen. It will be done to make the company’s wireless carrier business to decrease prices.

NTT is supposed to launch Japan’s biggest tender offer for 34% of the NTT Docomo stock. The firm does not own the stocks. The Japanese multinational system integration company will propose 3900 Japanese yen for every share.

The buyout arrives as the new prime minister of Japan has called on wireless carriers to lessen the prices. With his, the Japanese government will hope for resultant savings as it will eventually stimulate consumer spending.

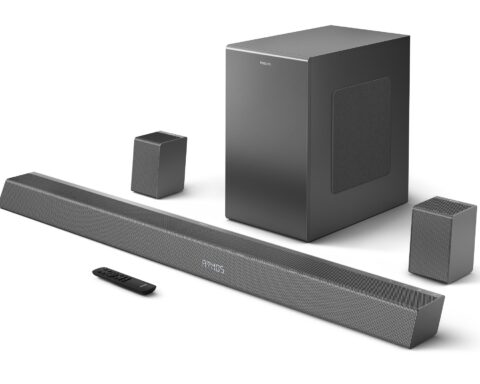

Image from Docomo

On 29th September, the Chief Cabinet Secretary said that there is a need for noticeable progress on reducing the mobile charges.

The chief executive of NTT has also said that the financial base of Docomo will become sturdier and it will give the company the capacity to cut the prices.

Further, the share price of the company has fallen as much as 5.8%. it has happened after NTT revealed that it was considering the buyout.

The government is trying to augment competition and have included backing the entry of Rakuten into the sector in 2020. This firm’s plan on a low-cost model can suffer, though, the prices should fall broadly.

In the meantime, government pricing pressure comes as carriers that is spend to make a 5th generation services which are extensively seen as critical to ensure Japan’s competitiveness.

The telecommunication firm has said that from the country’s biggest banks, it will fund the acquisition for around 4.3 trillion Japanese yen.