SoftBank, a Tokyo-based tech investor, has strategically divested a significant portion of its stake in Paytm, a leading Indian fintech firm, prior to the Reserve Bank of India’s (RBI) regulatory intervention, which precipitated a downturn in Paytm’s stock value. This move was driven by SoftBank’s apprehensions surrounding the regulatory uncertainty prevailing in India, coupled with uncertainties regarding the status of Paytm Payments Bank Ltd.’s license. Navneet Govil, SoftBank’s finance chief, emphasized the prudence of this decision, citing the necessity to hedge against potential risks posed by the evolving regulatory landscape. SoftBank initiated the sell-off of Paytm shares as early as November 2022, gradually reducing its stake from approximately 18.5% during Paytm’s initial public offering in 2021 to around 5% by January 2023.

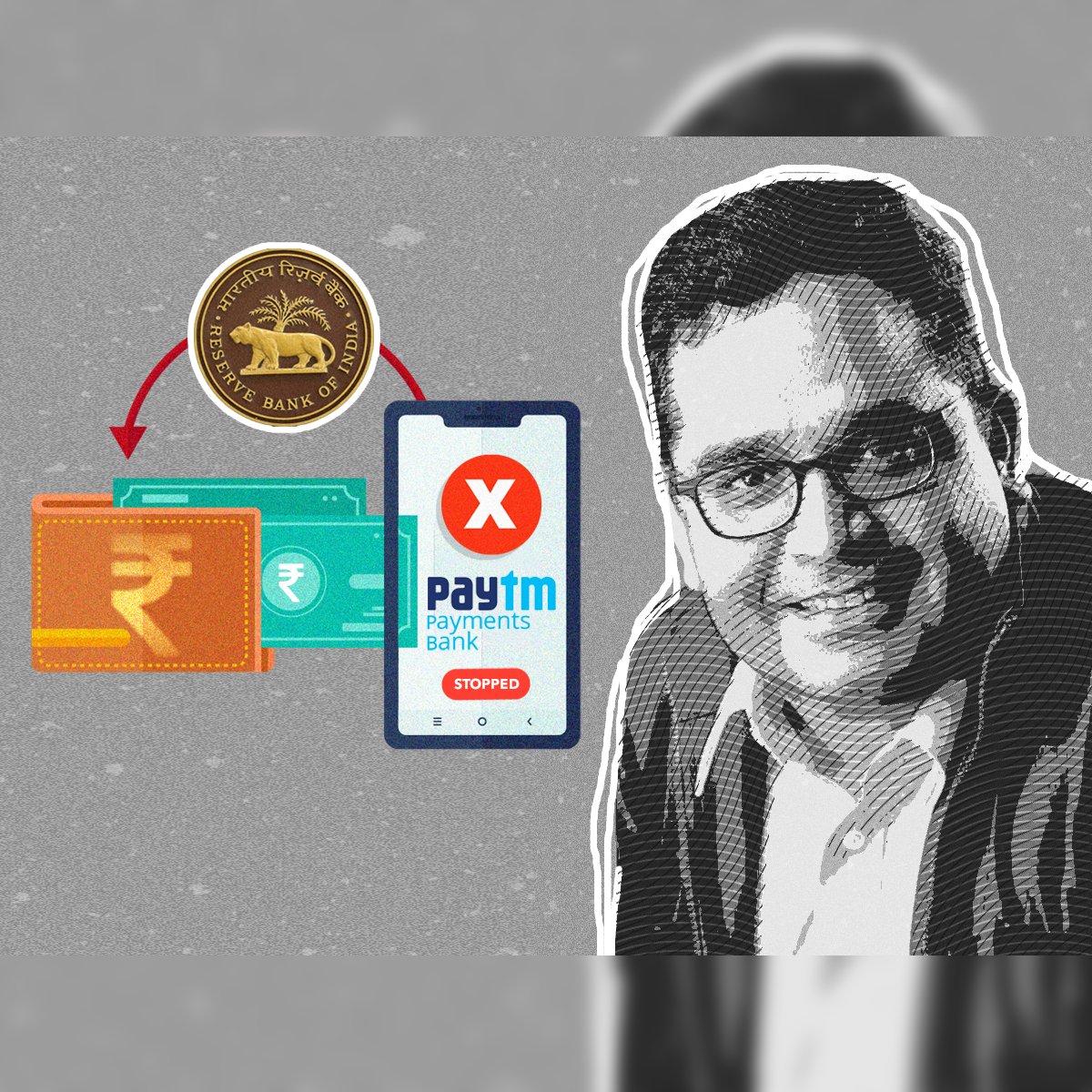

The regulatory concerns that prompted SoftBank’s divestment were primarily centered around the regulatory warnings issued to Paytm over the preceding two years, particularly regarding its payments app and banking operations. The RBI’s subsequent suspension of a significant portion of Paytm Payments Bank Ltd.’s business activities dealt a substantial blow to Paytm’s stock value, leading to a decline of over 40% from its peak in January. SoftBank’s decision to divest ahead of this downturn shielded it from potential losses incurred by the subsequent stock correction.

Despite SoftBank’s recent profitability, marking a reversal from four consecutive quarters of losses, and the positive performance of its Vision Fund in the December quarter, the investment firm has shifted its focus away from making new investments. Instead, SoftBank has prioritized exit strategies, divesting from existing holdings and streamlining its investment portfolio. This strategic pivot reflects SoftBank’s cautious approach in navigating the unpredictable dynamics of the Indian market, where regulatory uncertainties can significantly impact the performance of tech investments.

SoftBank’s decision to reduce its exposure to Paytm underscores the challenges posed by regulatory risks in emerging markets like India, where fintech companies operate within a complex regulatory framework. The regulatory scrutiny faced by Paytm serves as a cautionary tale for investors, highlighting the importance of closely monitoring regulatory developments and proactively managing investment portfolios to mitigate potential risks.

Looking ahead, SoftBank’s approach to investment in the Indian market may undergo further adjustments as it seeks to strike a balance between seizing growth opportunities and managing regulatory uncertainties. As the regulatory landscape continues to evolve, investors like SoftBank will need to adopt agile strategies to navigate the shifting terrain effectively. Ultimately, the success of tech investments in emerging markets hinges not only on identifying lucrative opportunities but also on effectively managing regulatory risks and ensuring compliance with evolving regulatory requirements.