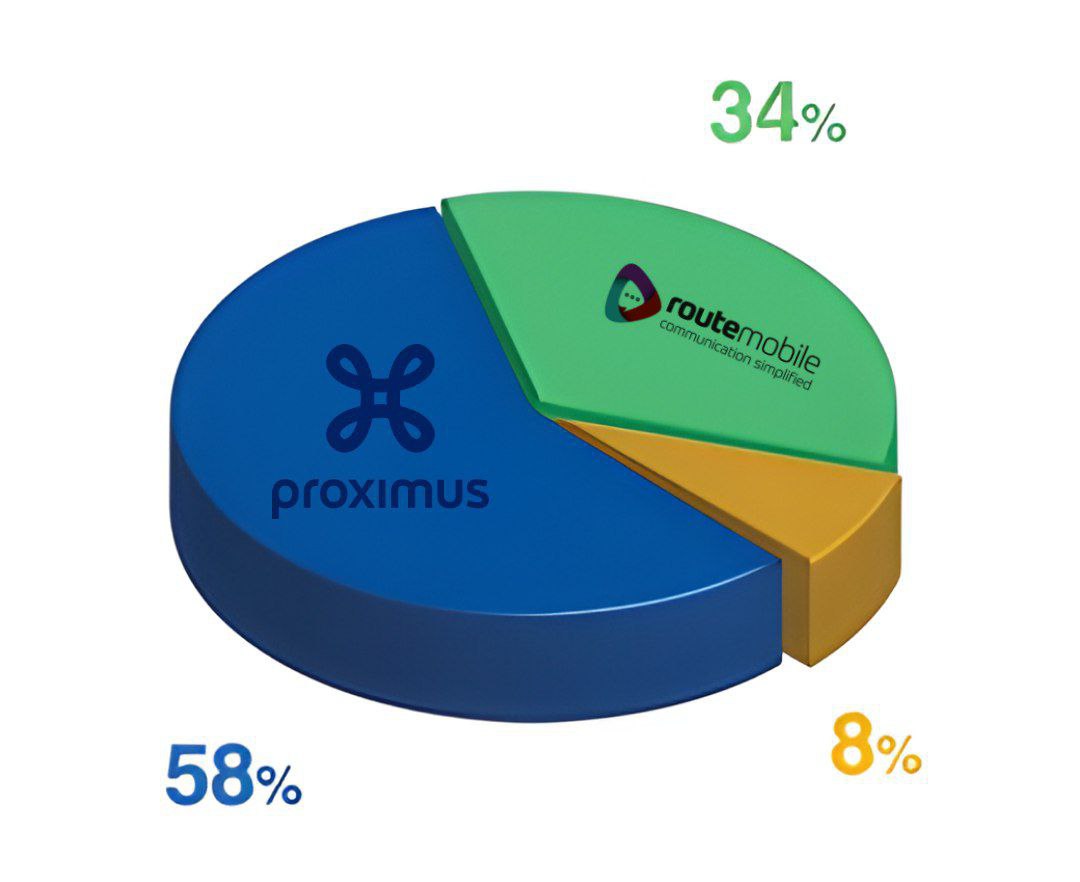

On Monday, Proximus Opal, the cloud-based telecom platform provider for enterprises based in Belgium, announced its intention to acquire a stake of nearly 58% in Route Mobile (ROUT.NS) for approximately 59.22 billion rupees ($721 million). This acquisition is valued at a similar level to the current market value of Route Mobile, its Indian counterpart.

Proximus Opal, which operates as a unit of Proximus Group, a prominent Belgian telecom service provider, boasts an impressive clientele that includes well-known companies like Salesforce and Bytedance. On the other hand, Route Mobile serves clients such as Amazon and Indian telecom giant Airtel, strengthening its position in the telecommunications market. This acquisition marks a defining moment for both companies and the entire telecom industry in Belgium, promising to reshape the dynamics of the nation’s communication ecosystem.

Proximus, a renowned name in Belgium’s telecommunications realm, has long been committed to providing innovative and reliable services to its customers. With a strong focus on expanding its reach and strengthening its position in the market, Proximus identified an opportunity to bolster its portfolio through strategic acquisitions. Enter Route Mobile, a company recognized for its expertise in cloud communication solutions and digital transformation services, which aligns perfectly with Proximus’s growth objectives.

The partnership… paves the way for Route Mobile to achieve a billion-dollar annual revenue run-rate much sooner than the anticipated 3-4 year time frame

said Rajdip Gupta, Route Mobile’s CEO, who will also lead the combined company.

As part of this deal, Proximus will gain a controlling stake in Route Mobile, enabling the company to leverage its technological prowess and global presence. This strategic move not only expands Proximus’s service offerings but also enhances its capabilities to cater to diverse customer needs.

Proximus Opal will pay 1,626.40 rupees per Route Mobile share, just 0.06% more than the closing price on Friday, for the 57.56% stake held by Route Mobile’s promoters, an Indian market term for large shareholders who can influence company policy. However, Clear Bridge Ventures, an affiliate of some Route Mobile promoters, will buy a minority stake of up to 14.5% in Proximus Opal for about 299.6 million euros (nearly $337 million).