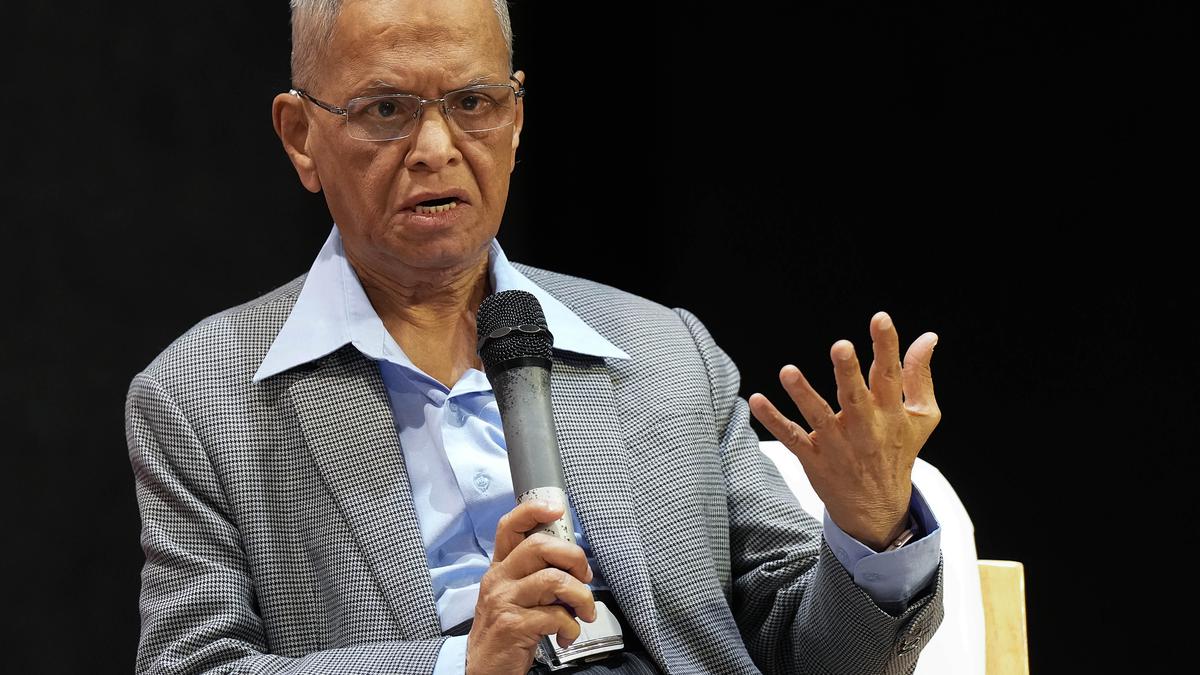

Infosys Co-Founder NR Narayana Murthy has gifted shares of the company worth more than Rs 240 crore to his four-month-old grandson Ekagrah Rohan Murty, as reported by Moneycontrol. While the details of this share transfer are not fully disclosed, it is essential to understand the tax implications of such gifts in India.

Gifts, like any other form of income, are subject to taxation under certain circumstances. However, there are scenarios where gifts may be exempt from tax. Here’s an overview of how gifts are currently taxed under Section 56 of the Income Tax Act in the hands of the recipient:

1. Money Gifts: If an individual receives money gifts, such as cash or cheques, taxation applies only if the aggregate value of such gifts exceeds Rs 50,000 in a year. Below this limit, no tax is applicable.

2. Movable Property: Receipt of specified movable properties without consideration or for inadequate consideration may also be subject to tax. If the aggregate fair market value of such properties exceeds Rs 50,000 in a year, the entire amount is taxable. This includes assets like jewellery, paintings, and securities.

3. Immovable Property: Similarly, the receipt of immovable property, such as land or buildings, without consideration or for inadequate consideration, may be taxable. If the stamp duty value of the property exceeds Rs 50,000, the entire value is subject to tax.

It is important to note that taxation applies only when gifts are received from non-relatives and exceed the Rs 50,000 limit. Gifts from relatives are not taxed under the Income Tax Act. Relatives include spouses, siblings, parents, grandparents, and lineal descendants.

Gifts received on occasions such as marriage or through inheritance are also exempt from tax. Additionally, gifts from certain funds, foundations, educational institutions, and charitable trusts may qualify for exemption under specific sections of the Income Tax Act.

The taxation of gifts serves to ensure transparency and fairness in financial transactions. By understanding the tax implications of gifts, individuals can make informed decisions regarding their financial planning and asset management.

In conclusion, while gifts can be a generous gesture, it is essential to consider the tax implications associated with them. By adhering to the regulations outlined in the Income Tax Act, individuals can navigate the complexities of gift taxation and ensure compliance with legal requirements.