On September 6, the National Payments Corporation of India (NPCI) unveiled a range of innovative products designed to propel the Unified Payments Interface (UPI) to achieve an ambitious target of 100 billion transactions per month. These new features include a credit line on UPI, a conversational payment mode named ‘Hello UPI,’ BillPay Connect, UPI Tap & Pay, and UPI Lite X.

The announcement follows a significant milestone achieved by UPI, which processed 10 billion transactions in August, prompting the NPCI to revise its monthly transaction target from 30 billion to an ambitious 100 billion. The launch event, held at the Global Fintech Fest in Mumbai on September 6, witnessed the presence of key figures such as Shaktikanta Das, Governor of the Reserve Bank of India (RBI), and Nandan Nilekani, co-founder and non-executive chairman of Infosys.

Nilekani praised NPCI as the “crown jewel of India’s technology sector” and highlighted its role in setting the stage for national information utilities. He emphasized the adoption of NPCI’s non-profit model in establishing similar bodies, such as GSTM for taxes, Digi Yatra app, and ONDC, to create digital public infrastructure. Nilekani expressed optimism that these entities would contribute substantial value as India undergoes a transformation from an offline, informal, and low-productivity economy to an online, formal, and high-productivity economy over the next two decades.

Key factors contributing to this transformation, according to Nilekani, include digital infrastructures like Aadhaar and UPI, along with the exponential growth of entrepreneurs. He noted a remarkable 10X increase in the number of startups in India, from 1,000 in 2016 to 100,000 in 2023.

Governor Shaktikanta Das acknowledged the success of UPI, citing impressive statistics of over 10 billion transactions totaling Rs. 15 trillion in value in August 2023. He attributed this success to India’s robust technology stack, which has accelerated digitalization through widespread mobile phone and internet usage.

In an exclusive interview with Moneycontrol, Prime Minister Narendra Modi highlighted the global appeal of UPI, recounting instances of foreign delegates being amazed at Indian street vendors accepting payments through UPI QR codes. He underscored India’s significant contribution, accounting for nearly half of the world’s real-time digital transactions.

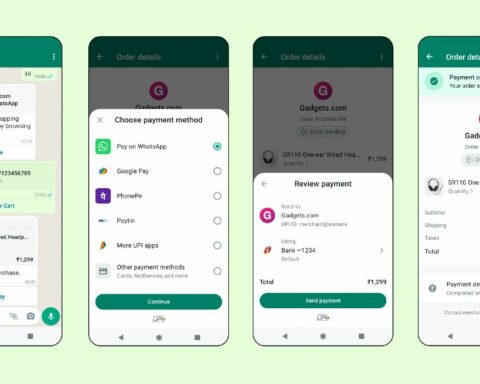

The newly launched UPI features aim to further enhance the user experience and expand the reach of digital payments in India. One notable feature is the introduction of a credit line on UPI, allowing users to make purchases by scanning a QR code through their UPI-linked apps, selecting a bank, entering the amount, and opting for a credit line.

“Hello UPI” introduces a conversational payment mode capable of understanding language and silence, converting text into numbers, and offering text-to-speech functionality. UPI Lite X caters to feature phone users, enabling peer-to-peer transactions without an active network or internet connection, utilizing near-field communication (NFC) technology.

A particularly intriguing feature, UPI Tap & Pay, involves tiny cards with embedded NFC chips linked to the user’s unique QR code and UPI ID. Users can generate these cards at partner banks, choosing designs and sticking them to their mobile phones for tap-based payments.

Overall, these innovations signify a bold step towards achieving the ambitious goal of 100 billion monthly transactions for UPI, aligning with India’s broader digitalization journey and commitment to transforming into a formal and high-productivity economy.