· Another Quarter of Strong Growth

· Revenue growth of 24.47% YoY & PAT growth of 124.18% YoY

· Unexecuted Orderbook of 897+MW to be executed in next 9-12 months

Waaree Renewable Technologies Limited (BSE: 534618), the Solar EPC / IPP subsidiary of Waaree Group, a solar developer that finances, constructs, owns and operates solar projects, has reported its unaudited financial results for the quarter ended September 30, 2023.

KEY PERFORMANCE HIGHLIGHTS

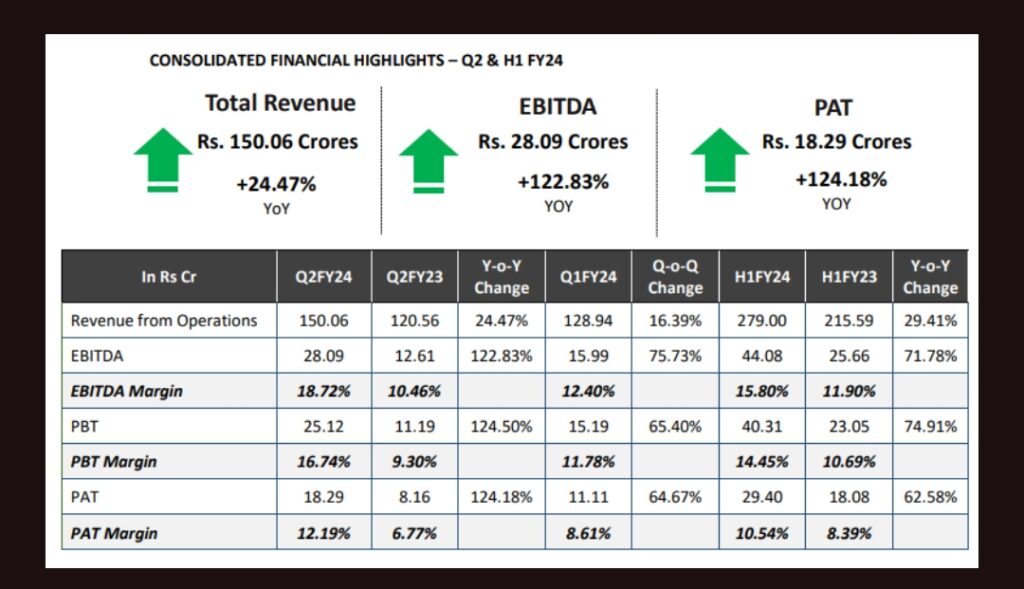

• Revenue for the Q2FY24 stood at Rs. 150.06 crores representing a growth of 24.47% YoY as compared to Rs. 120.56 crores in Q2FY23

• EBITDA for the Q2FY24 stood at Rs. 28.09 crores as compared to Rs. 12.61 crores in Q2FY23 representing a growth of 122.83% YoY

• Revenue for the H1FY24 stood at Rs. 279.00 crores as against Revenue of Rs. 215.59 crores in comparative period during H1FY23 representing growth of 29.41% YoY

• EBITDA for the H1FY24 grew by 71.78% from Rs. 25.66 crores in H1FY23 to Rs. 44.08 crores

• Order book Position:

o The unexecuted order book stands at 897+MW as of September 30, 2023

o Bidding pipeline remains robust

Commenting on the results Mr. Dilip Panjwani, CFO, Waaree Renewable Technologies Limited said: “The demand for energy remains robust and this growing demand is planned to be met by environment friendly renewable energy sources. India’s recent commitment to achieving net zero carbon emissions by 2070 and generating half of its electricity from renewables by 2030 marks a pivotal moment in the global campaign against climate change.

India’s renewable energy sector is experiencing unparalleled growth, with new capacity additions expected to double by 2026, thanks to increased government support and improved financial viability, making it an appealing prospect for investors. As the country works to meet its projected energy demand of 15,820 terawatt-hours by 2040, renewable energy is set to play a crucial role. The country aims to reach 450 gigawatts of installed renewable energy capacity by 2030, with solar contributing over 60%, or approximately 280 gigawatts.

The Company remains committed to bring latest innovation and solutions to optimise renewable energy in meeting the country’s climate change goals. The Company is adding IPP solutions to meet the demand for renewable power sources. In conclusion, our commitment to delivering solutions consistently aligns with the government’s vision for a transition to renewable energy sources, reduced carbon emissions, and climate change mitigation. With a promising long-term outlook driven by the global emphasis on clean energy and substantial solar capacity expansion by IPPs worldwide, our company is well-poised to seize this opportunity. We’re delighted to report a robust order book and a strong bidding pipeline, instilling confidence that we will meet the expectations of all our stakeholders. Our strong financial footing, characterized by a healthy balance sheet, net cash reserves, and a disciplined working capital cycle, empowers us to execute profitable projects with higher returns.”